What You Should Know About Financial Planning For Your Future

Many people find themselves in a situation where they are ill-equipped to handle an emergency situation. This could be something like medical debt, an unexpected layoff, or other financial problems that might occur. These suggestions can help you get started on taking charge of your financial future no matter where you are at in life.

Start an Emergency Savings

Often underrated, an emergency savings account can help you if you have a pressing financial matter to take care of. The general number is usually $1,000 for emergency savings, but that can be adjusted based on your family size and where you live. This type of emergency savings could be helpful if you have an expected expense, like car repairs to make.

You could also save up for more long-term emergency situations, such as being out of work for reasons beyond your control. Usually, this would be enough money to last you anywhere from three to six months. Having both types of accounts can ensure you will be ready for anything that comes your way.

Work on Paying Off Debt

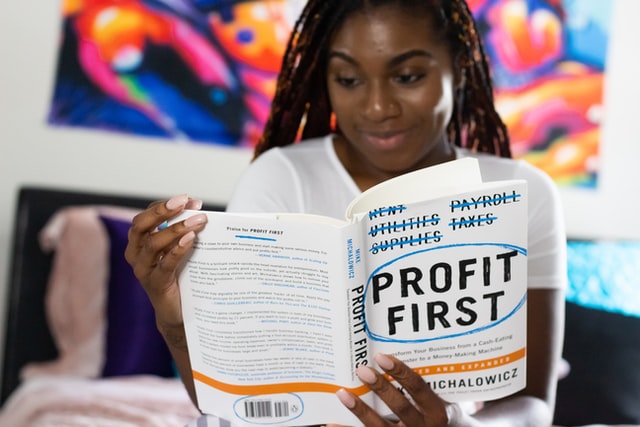

Once you have enough money saved for possible financial situations, work on paying off any debt that you currently have. It might be easier to start with the smallest debt first and ensure that is paid off as quickly as possible, before moving on to the next debt.

Paying debt off in this manner is known as snowballing. It can be very rewarding to see that you have already done everything necessary to pay off one debt, and you’ll feel encouraged to keep the practice up.

Talk With a Professional About Your Needs

After completing both tasks, you should think about your future. It can be helpful to talk with a financial planner about what you need to do to protect yourself and your family. This is especially important if you find yourself in a situation where you have unique needs, like a disability.

Working with someone who has knowledge of your situation, like financial planning for people with disabilities, can help you learn about the best ways to save and get ready for the future.

When you are trying to focus on getting your finances in order, it helps to have emergency savings and work on paying off outstanding debt. Consulting with a financial planner can give you ideas on what the next area of focus should be, no matter what your needs are.